SEC Filings & Regulatory Disclosures

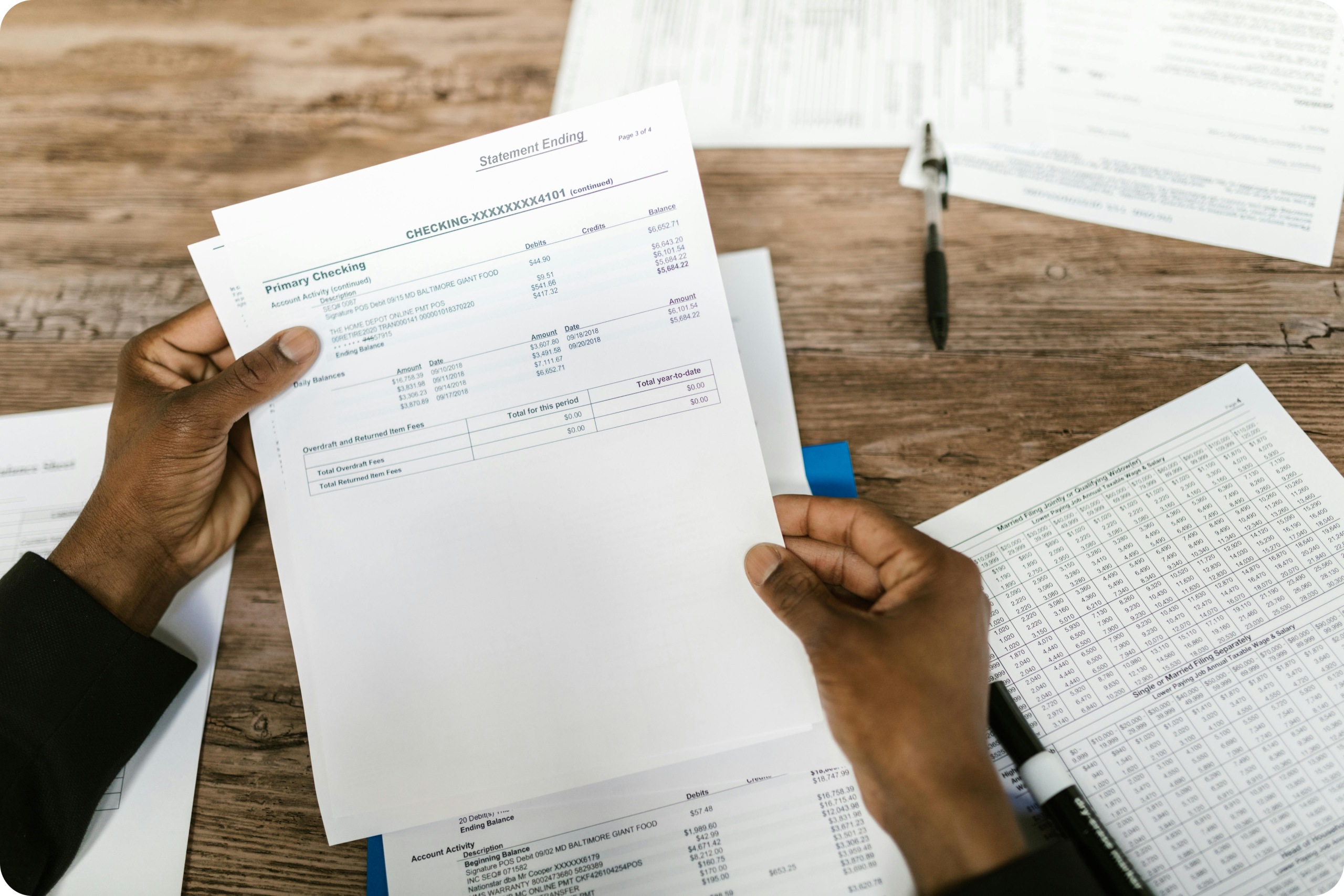

In mid-to-late January 2026, new regulatory disclosures and company filings were published through the U.S. Securities and Exchange Commission’s EDGAR system. These documents provide investors with updated information on financial condition, corporate events, and regulatory compliance.

07/01/2026

Corporate Disclosure Updates via the EDGAR System

Publications include not only regular reports such as quarterly and annual financial statements, but also notices of significant events, press releases, presentations to investors, and other forms of disclosure required by the U.S. Securities and Exchange Commission (SEC). These publications cover a wide range of data: financial results, changes in management and board of directors, securities transactions, strategic initiatives, acquisitions and mergers, as well as key events that may have an impact on the company's share price or operations. Access to such data increases the transparency of companies' work and allows market participants — investors, analysts, creditors and other stakeholders — to take timely account of changes in their operational and financial dynamics. This, in turn, contributes to more informed investment decisions, reducing risks and improving the assessment of business prospects. Regular and transparent disclosure of information ensures market confidence, supports fair pricing of securities, and contributes to the efficient functioning of financial markets. In addition, such publications allow you to track trends in the industry, identify potential growth opportunities and respond to changes in the corporate strategy of companies. Modern platforms and information disclosure services make this data available in real time, which is especially important for institutional investors and participants in high-dynamic markets.

Importance of Regulatory Filings for Investment Analysis

Regulatory disclosures remain a critical source of reliable information for assessing risks, strategic shifts, and business resilience. Systematic monitoring of EDGAR materials helps investors make more informed decisions and track long-term trends across public companies.

Want to suggest a publication?

Leave a request and we will contact you

Explore our other recent insights