Smart investments - a confident future

Investment solutions for your financial growth

125B

Private equity

144M

Investments

77B

Private equity

355M

Investments

441M

Investments

WHO ARE WE?

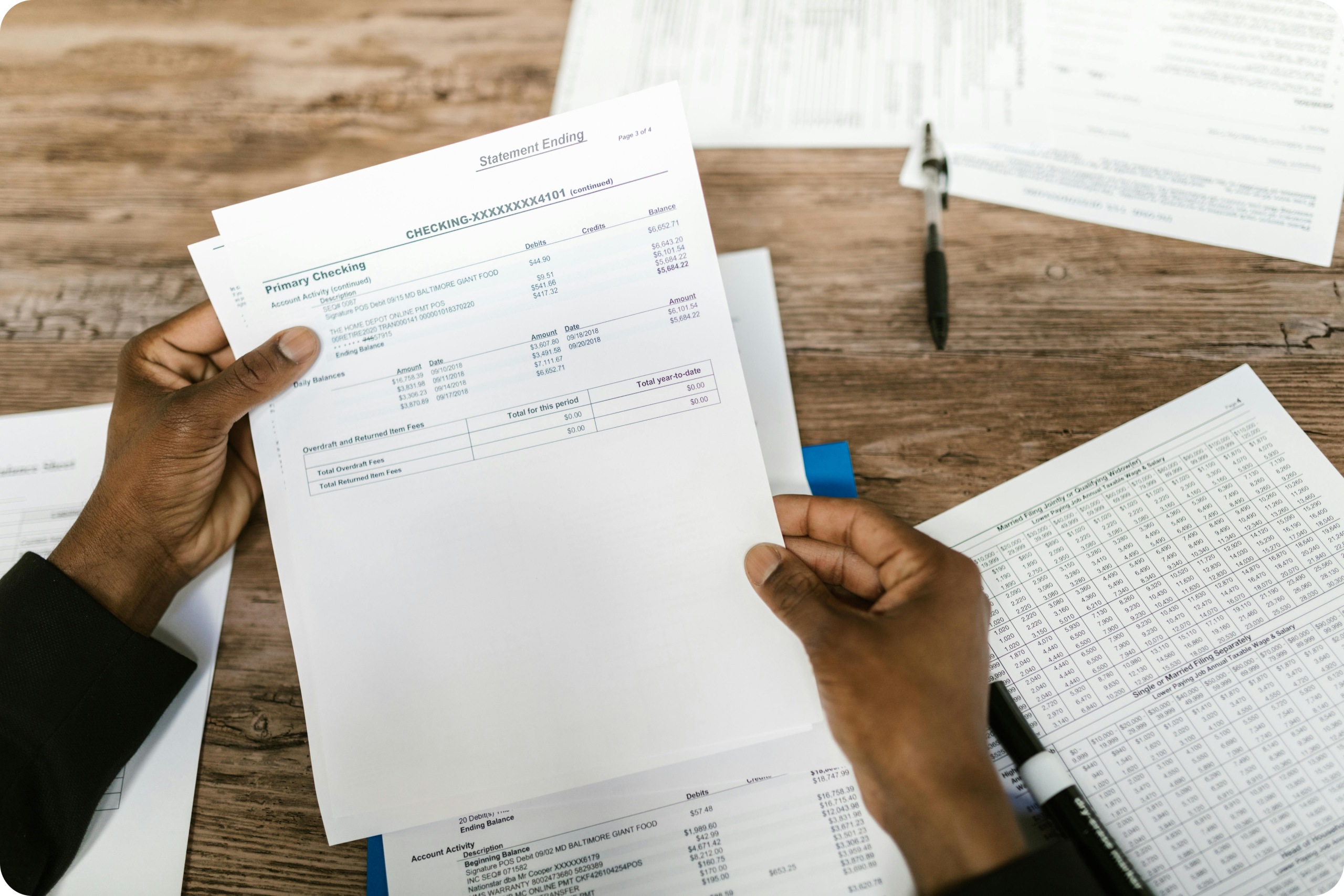

Almak Capital provides its clients with a wide range of investments, including direct investments in companies in various industries, venture investments in start-up companies and early growth companies, as well as investments in the stock markets of the USA, Europe, Asia and the CIS.

Learn more about Almak CapitalPrivate Equity

At Almak Capital, we invest in resilient, high-potential companies and support their expansion and operational excellence. More than capital providers, we act as strategic partners focused on long-term value creation. Our active ownership approach helps transform businesses and unlock sustainable growth.

Venture Capital

We back early-stage startups and tech-driven ventures with capital, expertise, and access to Almak Capital’s global network. Our mission is to fuel innovation by supporting bold ideas and visionary founders. We embed ESG principles into our investment process to promote sustainable and scalable success.

Wealth Management

At Almak Capital, we craft tailored strategies to preserve and grow your wealth, combining deep market insight with a disciplined investment approach. More than advisors, we act as trusted partners, aligning our solutions with your long-term financial goals. Our proactive management ensures resilience, maximizes opportunities, and secures enduring prosperity.

Public Markets

We invest in public companies with strong fundamentals and long-term growth potential. Almak Capital’s active management approach seeks to identify undervalued assets and deliver superior risk-adjusted returns. Our decisions are grounded in deep research and market insight.

Advisory

Almak Capital’s advisory team provides strategic, financial, and transactional guidance to clients navigating complex challenges. From M&A to capital structure optimization, we deliver independent, data-driven advice. We are trusted partners committed to helping our clients achieve lasting success.